For international students, managing finances effectively is crucial to maintaining a balanced and stress-free life in the USA. The cost of living, tuition fees, and other expenses can quickly add up, making it essential to develop a robust budget as an international student. During the post covid era, the cost of living in USA has increased by at least ~20%; in bigger cities the spike is even higher. Whether you are just starting your journey or looking for ways to optimize your spending, this blog post will provide you with the tools and insights needed for making successful money management.

Understanding Your Financial Situation:

Before you plan a budget as an international student, it is critical to understand your financial situation. This includes knowing your income sources, expected expenses, and any savings you have. Here’s how to get started:

Identify Your Income Sources:

As an international student in USA, your income may come from various sources such as fellowships, research or teaching assistantships, part-time jobs, or financial support from family. Please note that F1 students in USA are only allowed to do on campus jobs for 20 hrs per week, and during summer 40 hrs per week. There are certain special cases where you might get a permit to work off campus during regular semesters, but you should not count on that. Therefore, your income will be highly limited by the on campus earning opportunities or the research or teaching assistantship you will get.

Estimate Your Expenses:

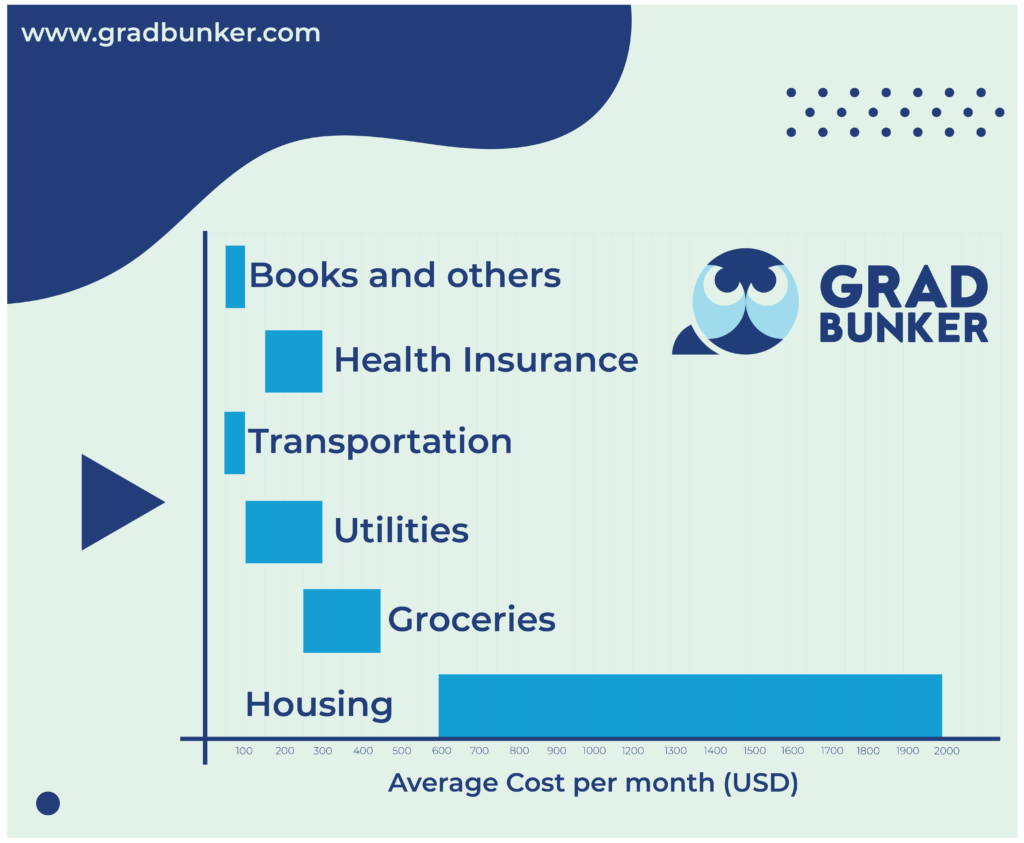

List all your anticipated monthly expenses. This should include tuition fees, rent, utilities, groceries, transportation, textbooks, and entertainment. Don’t forget to account for unexpected costs like medical emergencies or travel.

By clearly understanding your financial picture, you can create a realistic budget that aligns with your income and expenses, setting a solid foundation for effective money management.

Creating a Practical Budget:

Once you have a clear picture of your financial situation, it’s time to create a budget that will help you manage your money efficiently. However, living on a budget as an international student does not mean that you have to sacrifice your quality of life. Here are some tips to help you save money without compromising your comfort.

Plan for Your Tuition First:

If you are a funded international student then your tuition fee will come from your fellowship or assistantship money. However, a lot of students plan to come to USA as a self funded for the first semester, and try to manage funding to cover the rest of their studies. This is a feasible plan but you need to make sure that you have some backup source to pay your tuition fees. If you academically perform well in your first semester, then you might be considered for teaching assistantship in your department. Most of the open TA positions are awarded semester wise, and you can apply for those. Sometimes Professors need students immediately to work on their most recent funded projects. You should be very vigilant in finding such opportunities. But regardless of what you might get in the future, always have backup resources to finance your study abroad.

Find Affordable Housing:

Consider living in shared accommodation at off-campus housing to reduce your rent expenses unless you are married. Your average rental cost will decrease by at least 50 percent if you live in a shared apartment. As a student, you will spend most of your time in university, such as attending classes, working in labs or on campus, studying in libraries, etc. Avoiding living in fancy housing will definitely help you to budget as an international student.

You should look for such a place that offers basic perks such as a gated community, on-site laundry, etc. And make sure that the neighborhood has a minimum crime rate. This will help you to keep your rent as low as possible. Also, try to get reviews of the apartment communities from Google to see whether the residents are satisfied with the living conditions. Some apartments are very old and trash, and the management do not really care about taking care of the properties.

Prevent Your Financial Leaks:

You would like to live low on your fixed costs, but you should not keep it loose regarding your variable costs and utilities. For example, a solo phone plan from carriers such as T-mobile, Verizon might cost you 45 USD, where you and with other friends can go for a family plan together and can save at least 20 bucks per month. Some other companies such Mint Mobile offers cell phone plan for 15 USD per month. Sometimes we say it is just 20 bucks, but instead of spending if you prevent that leak it will add up to 240 bucks a year.

Buy Used Cars:

In my life, I have seen a lot of funded Ph.D. students buying a new car, whether they spent most of their time in the lab and barely made long-distance travel (e.g., 10 to 15 hrs drive or more) for multiple days during their graduate life. A new car loses ~11% of its value the moment it hits the road from the dealer. Even if you can afford it you might think of saving extra money and investing it in building wealth, such as buying stocks. Moreover, your insurance will be higher on brand new cars as you will get the full coverage to protect it as well. Rather plan to buy a used car within budget and use it for your daily commute. For longer-distance travel, you can always rent a car.

Use Public Transportation:

Even owning a used car can be expensive due to costs like gas, insurance, and maintenance. In big cities, you can easily commute by bus or streetcar. You will find at least one or two big groceries within 2-3 miles of your campus, where you can easily commute via public transport. Use public transport whenever you can; at least you will save money on gas.

Cook at Home:

Eating out can quickly drain your budget. Cooking at home is not only healthier, but also significantly cheaper. Learn to live with one dish meals; it will significantly reduce your cooking burden. As a graduate student, finding time to cook every day is hard. You might plan to cook your weekly meals during the weekend and properly refrigerate them. This habit will help you save money and bless you with abundant time during your busy days.

Take Advantage on Student Discounts:

Many businesses offer discounts to students. Always carry your student ID and ask about discounts at restaurants, stores, and entertainment venues. Especially when you are making big purchases such as laptops, smartphones, cameras, etc., try to purchase from vendors who offer student discounts.

Use Credit Cards Wisely:

In the USA, you will need credit scores for almost everything. For example, the owner will look at your credit score if you want to rent an apartment. Companies will look at your credit score to evaluate your financial awareness. So, you need to spend from your credit cards to build your credit score. However, the problem that arises later is that credit cards change your spending habits. You start to spend over. Therefore, use your credit card wisely and spend only that amount which you can pay back in full within the next billing cycle or, if not, during the APR-free period. Credit card companies make money on the interest they charge for unpaid bills, which add up at a compound rate.

Invest in Stocks:

None has ever taught me this wealth-building habit in the USA. If you are unmarried and your cost of living is comparably lower instead of stashing all the money in your bank accounts, invest some of it in stocks. As an international student you cannot day trade, but no rule forbids you to buy stocks. However, make sure you educate yourself before buying stocks. And also, do not put all of your money into it.

Make Market Place Your Best Friend:

At the end of every semester, students graduate and a handful of them move to other states. While moving out, they sell almost everything, such as mattresses, furniture, books, etc. As those are being used by students like you and me, most of them remain in good condition. So whenever you need something, always look for it in the marketplace. You might find a pretty good deal.

Earning Extra:

In addition to managing your expenses, earning extra income can provide additional financial security and flexibility. F1 students are not allowed to work for 40 hrs except for summer. During the summer, you may try to find some on-campus jobs that might bring you some extra income. Also, depending on your research work, you might discuss it with your supervisor, and with permission, you can look for an internship during the summer. This will not only bring you a fortune but will also bless you with industry work experience that will help you to secure a job.

Making a budget as an international student in the USA can be challenging, but with careful planning and disciplined money management, it’s entirely possible to thrive financially. You can achieve a balanced and fulfilling student life by understanding your financial situation, creating a practical budget, cutting costs, and finding ways to earn extra income. We hope these tips help you manage your finances effectively. Have any questions or tips of your own? Leave a comment below and join the conversation!

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job